Time to Take Care of Your Tax Returns

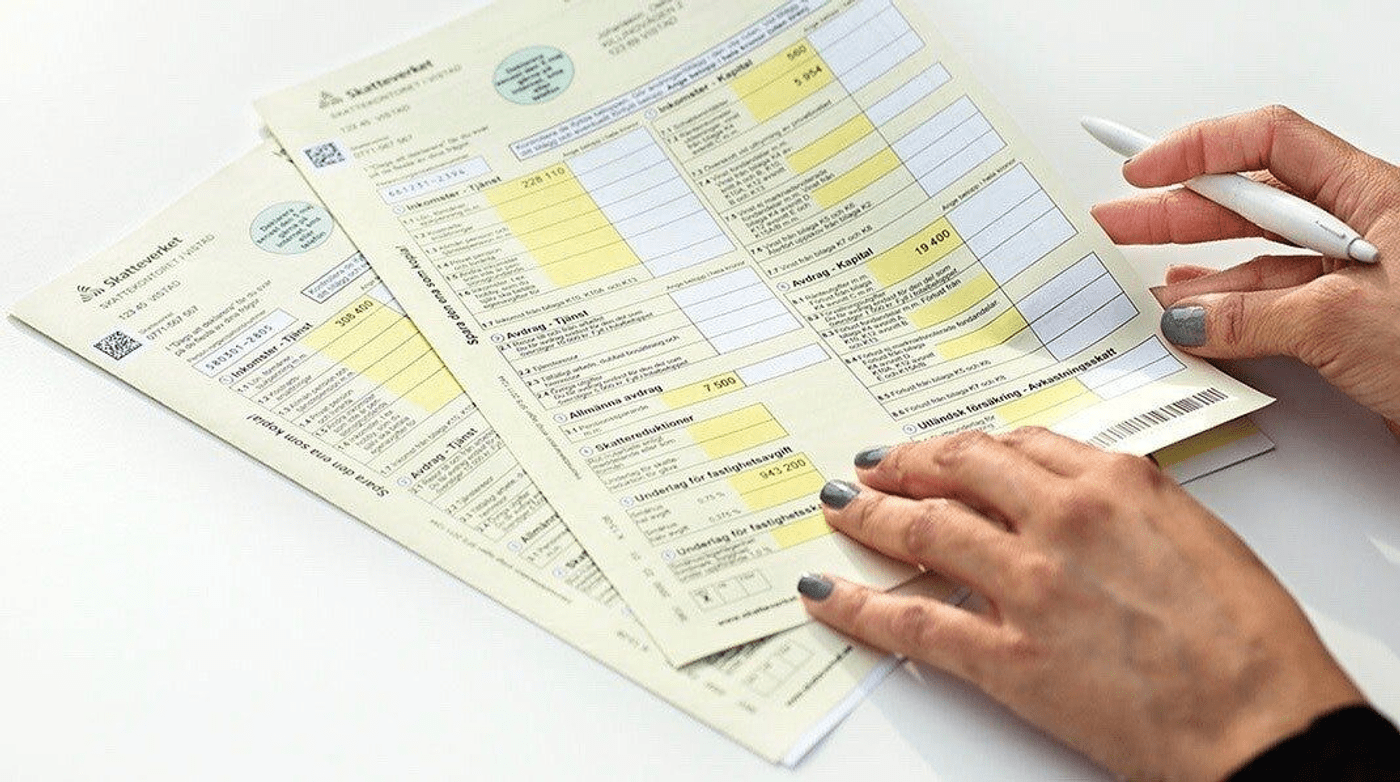

For all taxpayers in Sweden - this is a kind reminder to everyone who earned any income in Sweden during 2024 to file your tax returns between March 18th and May 2nd this year.

You either already received or about to receive your Income Declaration 1 (Inkomstdeklaration 1) which you are supposed to check (whether everything is correct) and send back to the Swedish Tax Service (Skatteverket) either digitally or by mail.

Some prefer to handle it in person while others hire accountants by giving them a power of attorney (POA). Whatever way is chosen, it is critically important not to miss the deadline. Once everything is done properly, the the actual tax returns will be received in June or July 2025.